Tech-Driven Mortgage Staffing: How IoT and Smart Technologies Are Shaping the Future of Talent Acquisition

In today’s rapidly changing real estate and financial services landscape, finding the right talent is more critical than ever. The rise of Internet of Things (IoT) devices and smart home technologies has transformed how mortgage companies operate and make lending decisions. This new environment requires professionals who not only understand traditional mortgage processes but also possess the technological savvy to leverage data-driven insights. This is where mortgage staffing solutions come into play, helping companies build teams that bridge the gap between finance and technology.

This article explores how the integration of IoT and emerging digital tools are reshaping mortgage staffing, the evolving skillsets required, and the strategic benefits of partnering with specialized staffing agencies in this dynamic market.

The Impact of IoT and Smart Technologies on Mortgage Lending

The mortgage industry is undergoing a digital transformation fueled by data-rich IoT devices embedded in homes. Smart thermostats, security cameras, energy monitors, and leak detectors provide lenders with real-time information about property conditions and usage patterns. This continuous data stream enhances risk assessment and underwriting by offering more accurate insights into a property’s value and safety.

For example, if a smart water sensor detects a leak early, lenders can mitigate potential damage risks before approving a loan. Similarly, smart energy usage data can influence appraisal values and loan terms, allowing more tailored mortgage products.

Besides IoT, the adoption of digital mortgage platforms accelerates loan application, verification, and approval processes, making speed and accuracy paramount. These tech advancements demand mortgage professionals who understand both financial principles and the digital tools that enhance them.

Evolving Skill Sets: Bridging Finance and Technology

The mortgage workforce must now adapt to hybrid roles combining traditional expertise with technological proficiency:

- Loan officers utilize fintech platforms to guide clients through seamless online application and approval processes.

- Underwriters interpret IoT data and predictive analytics to make smarter lending decisions.

- Appraisers and inspectors use drones and 3D imaging tools for remote property assessments, reducing turnaround time.

- Data analysts analyze big data and IoT metrics to optimize loan portfolios and anticipate market trends.

Finding professionals who possess this unique combination of finance knowledge and tech skills is challenging through conventional recruitment methods.

The Role of Mortgage Staffing Agencies in Navigating Tech Talent

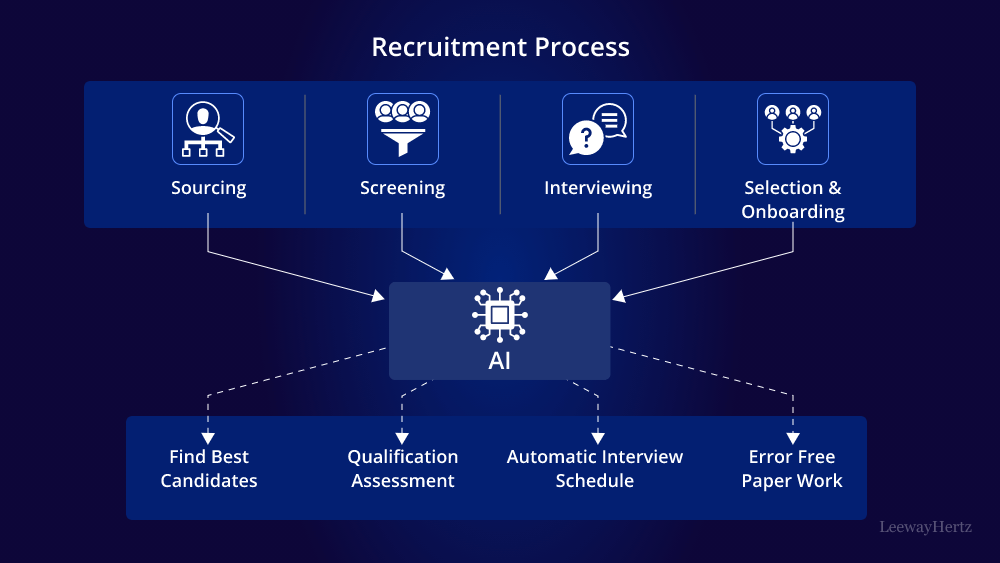

Specialized mortgage staffing firms like TalentCore Solutions are essential partners for lenders embracing this tech revolution. They maintain pools of candidates who are not only experienced in mortgage finance but also proficient with emerging digital tools and IoT ecosystems.

These agencies utilize AI-driven recruitment platforms that match candidates based on nuanced criteria, including technical skills, industry certifications, and cultural fit. This precise matching significantly reduces hiring cycles and improves retention.

Moreover, these firms offer flexible staffing solutions such as contract, temp-to-perm, or direct hire placements, enabling mortgage companies to scale talent based on fluctuating market demands.

Agility in a Market Defined by Change

Mortgage lending volumes often vary due to interest rate shifts, regulatory changes, and economic factors. The ability to quickly adjust team size and expertise is vital:

- Temporary or contract mortgage professionals can be brought in during peak lending seasons or for specialized projects.

- Remote staffing options expand talent pools beyond local markets.

- Scalable hiring models reduce long-term commitments and costs during slowdowns.

Mortgage staffing agencies provide this agility, ensuring firms remain responsive without sacrificing talent quality.

Cost Efficiency and Risk Mitigation

Although contract mortgage staffing may seem costlier upfront, the overall financial benefits are significant:

- Reduced onboarding time and administrative overhead.

- No long-term salary or benefits commitments for short-term needs.

- Lower risk of bad hires thanks to rigorous vetting processes and industry expertise.

Conversely, traditional recruitment often involves lengthy hiring cycles, higher turnover risk, and hidden costs associated with poor hires.

Preparing for the Future: Strategic Workforce Planning

Mortgage lenders must align their talent acquisition strategies with technological innovation:

- Embrace specialized staffing partners who understand both mortgage and tech landscapes.

- Invest in continuous training to keep employees updated on new fintech and IoT tools.

- Adopt recruitment technology to streamline candidate sourcing and evaluation.

These proactive steps ensure a future-ready mortgage workforce capable of delivering superior customer experiences and operational efficiency.

Conclusion

The integration of IoT and smart technologies into mortgage lending demands a fundamental shift in staffing approaches. By partnering with expert mortgage staffing agencies, lenders can access a talent pool that combines financial expertise with technological savvy, enabling them to navigate this evolving landscape effectively. This strategic investment in human capital enhances loan processing speed, risk management, and customer satisfaction, positioning mortgage companies for sustainable success in a digital-first world.